2022 Jiaxing EDZ · Hurun Global 500

The Hurun Research Institute today, in association with Jiaxing City in East China, released the 2022 Hurun Global 500, a list of the 500 most valuable non-state-controlled companies in the world. Companies were ranked according to their value, defined as market capitalisation for listed companies and valuations for non-listed companies. The cut-off date used was 26 October 2022.

JIAXING EDZ · HURUN GLOBAL 500 2022

APPLE RETAINS TITLE OF MOST VALUABLE COMPANY IN WORLD, WORTH US$2.4 TN, DOWN 3%

MICROSOFT SECOND, WORTH US$1.8 TN, DOWN 15%. ALPHABET OVERTAKES AMAZON FOR THIRD PLACE. WORLD’S BIG 4’ APPLE, MICROSOFT, ALPHABET AND AMAZON DOWN 17% IN PAST YEAR, BUT STILL MAKE UP 14% OF HURUN GLOBAL 500 MOST VALUABLE COMPANIES.

HURUN GLOBAL 500 LOSE US$11.1 TN (19%) OF THEIR VALUE, LOSING THE EQUIVALENT OF US$31 BN A DAY FOR THE PAST YEAR. THEIR TOTAL VALUE NOW US$46.8 TN.

15 COMPANIES BROKE INTO THE TOP 100 THIS YEAR, LED BY ENERGY GIANT CONOCO PHILIPS UP 142 PLACES TO 55TH, AFTER SEEING VALUE DOUBLE TO US$158 BN.

ELON MUSK. TESLA UP 3 PLACES TO 5TH WITH VALUE US$672 BN, MORE THAN NEXT 8 CARMAKERS COMBINED. SPACEX, LARGEST UNICORN IN USA, UP 134 PLACES TO 81ST WITH US$125 BN VALUATION. TWITTER DOWN 32% TO US$38BN.

INDIA-BASED BILLIONAIRE GAUTAM ADANI HAD FOUR NEW ENTRANTS WORTH A TOTAL OF US$173 BN IN THIS YEAR’S HURUN GLOBAL 500: ADANI TRANSMISSION, ADANI GREEN ENERGY, ADANI ENTERPRISES AND ADANI TOTAL GAS.

BY COUNTRY, USA DOMINATES, UP 17 COMPANIES TO 260 OR 52% OF THE HURUN GLOBAL 500, MAKING UP 65% OF TOTAL VALUE.

CHINA SECOND WITH 35 COMPANIES, DOWN 12, FOLLOWED BY JAPAN 28, DOWN 2, AND UK 21, DOWN 3. INDIA AND CANADA MOVED UP TO FIFTH PLACE WITH 20 COMPANIES EACH, ADDING 8 AND 3 COMPANIES RESPECTIVELY, OVERTAKING FRANCE AND GERMANY, DOWN 2 AND 4 TO 17 AND 16.

CITY-WISE, NEW YORK IS BASE TO 31, UP 3, OF THE HURUN G500, FOLLOWED BY TOKYO WITH 16, DOWN 1, AND LONDON WITH 15, DOWN 2. MUMBAI MOVED UP 3 PLACES TO 5TH.

BIGGEST GAINERS WERE ENERGY COMPANIES EXXON MOBIL, UP US$198 BN, AND CHEVRON CORPORATION, UP US$149 BN, FOLLOWED BY INSURANCE COMPANY UNITED HEALTH GROUP US$103 BN, ON BACK OF PICKUP IN PRIVATE HEALTH INSURANCE WITH COVID OUTBREAK. BOTH EXXON MOBIL AND UNITED HEALTH GROUP BROKE INTO TOP TEN.

MEDIA & ENTERTAINMENT COMPANIES SUFFERED BIGGEST DROPS IN VALUE, FOLLLOWED BY RETAIL AND SOFTWARE & SERVICES.

BIGGEST LOSSES IN VALUE: META PLATFORMS, DOWN US$618 BN, AND AMAZON DOWN US$587 BN. CHINA-BASE TENCENT AND ALIBABA WERE THIRD AND FOURTH. IN PERCENTAGE TERMS CANADIAN E-COMMERCE PLATFORM SHOPIFY LOST 79%, FOLLOWED BY PAYPAL 72%.

68 COMPANIES DROPPED OFF, DESPITE CUT-OFF FALLING 23% FROM US$36.6BN LAST YEAR TO US$28BN THIS YEAR. ZOOM, WITH VALUE LAST YEAR OF US$107 BN, WAS BIGGEST CASUALTY. OTHER DROPOFFS INCLUDES SNAP, KUAISHOU, ADIDAS, WUXI BIOLOGICS AND DELL TECHNOLOGIES. USA LOST 25 COMPANIES, CHINA 16.

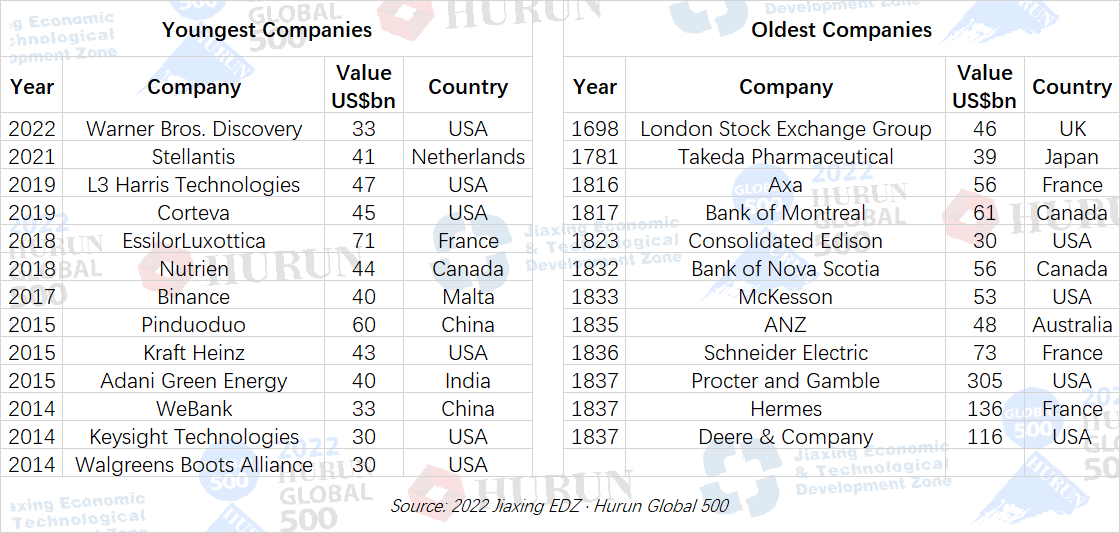

AVERAGE AGE 65 YEARS, UP 2 YRS, OF WHICH 123 COMPANIES, UP 4, OLDER THAN 100YRS.

62 START-UPS, DOWN 6, FOUNDED IN 2000S, LED BY CRYPTO EXCHANGE BINANCE FOUNDED IN 2017, CHINESE ECOMMERCE PLATFORM PINDUODUO FOUNDED IN 2015, SHENZHEN-BASED WEBANK IN 2014 AND INDIA-BASED ADANI TRANSMISSION IN 2013.

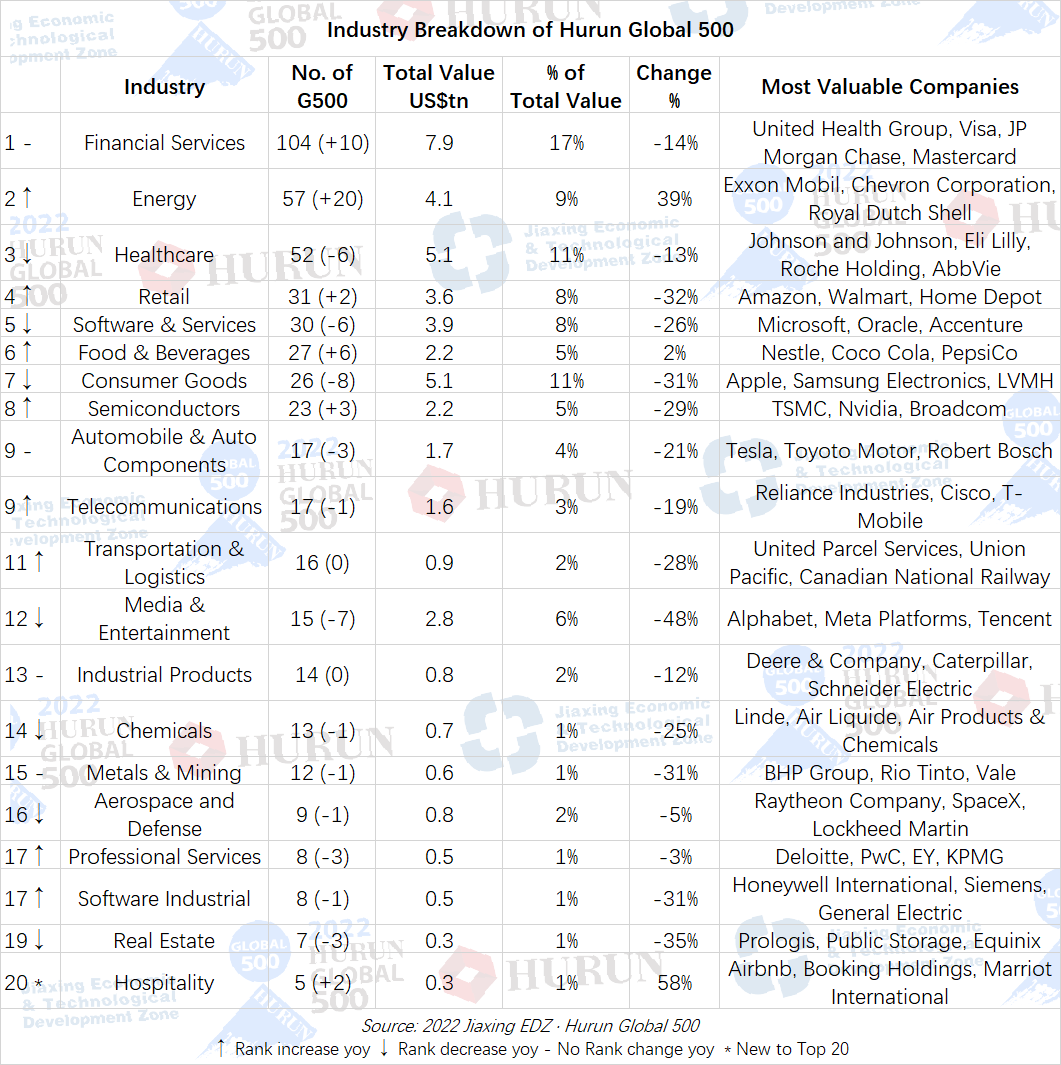

FINANCIAL SERVICES BIGGEST CONTRIBUTOR TO THE HURUN GLOBAL 500 WITH 21% OR 104 COMPANIES, UP 10, LED BY UNITED HEALTH GROUP, VISA AND JP MORGAN CHASE.

ENERGY WAS THE BIGGEST WINNER OF THE YEAR, ON BACK OF SHARP RISE IN OIL & GAS TRIGGERED BY RUSSIA-UKRAINE WAR, OVERTAKING HEALTHCARE FOR SECOND PLACE. 57 ENERGY COMPANIES, UP 20, ADDED US$1.2 TN OF VALUE TO TOTAL OF $4.1 TN. HOUSTON-BASED CONOCO PHILIPS, EOG RESOURCES AND SCHLUMBERGER FASTEST-GROWING, WITH CONOCO PHILIPS DOUBLING IN VALUE TO US$158 BN, SHOOTING IT UP 142 PLACES TO 55TH.

FOOD & BEVERAGES WAS ONLY OTHER SECTOR TO GROW IN VALUE, GROWING BY 2%, WITH MARS, PEPSICO AND MCDONALD’S GROWING BY AN AVERAGE OF US$20BN EACH.

IRAN, TURKEY, POLAND, THAILAND, ISRAEL AND NORWAY ARE THE LARGEST COUNTRIES BY GDP WITHOUT A HURUN GLOBAL 500 COMPANY

CHINA 35 COMPANIES, DOWN 12, WORTH US$2.6 TN. TSMC WORTH US$317 BN (DOWN 44%) OBERTOOK TENCENT WORTH US$265 BN (DOWN 62%). OVER 60% OF NON-CHINA HURUN GLOBAL 500 HAVE A REGIONAL PRESENCE IN CHINA, WITH 60% HEADQUARTERED IN SHANGHAI, FOLLOWED BY 30% IN BEIJING.

INDIA 20 COMPANIES, RISING TO 5TH PLACE, LED BY ENERGY GIANT RELIANCE INDUSTRIES WITH US$202BN, UP 7%, AND TATA CONSULTANCY SERVICES WITH US$139BN, FOLLOWED BY HDFC BANK WITH US$97BN. 50% OR 252 OF THE NON-INDIA HURUN GLOBAL 500 HAVE A REGIONAL PRESENCE IN INDIA, SPREAD ACROSS TEN CITIES. MUMBAI LED WITH 93, FOLLOWED BY BENGALURU WITH 50, GURUGRAM 33, NEW DELHI 21 AND PUNE WITH 11.

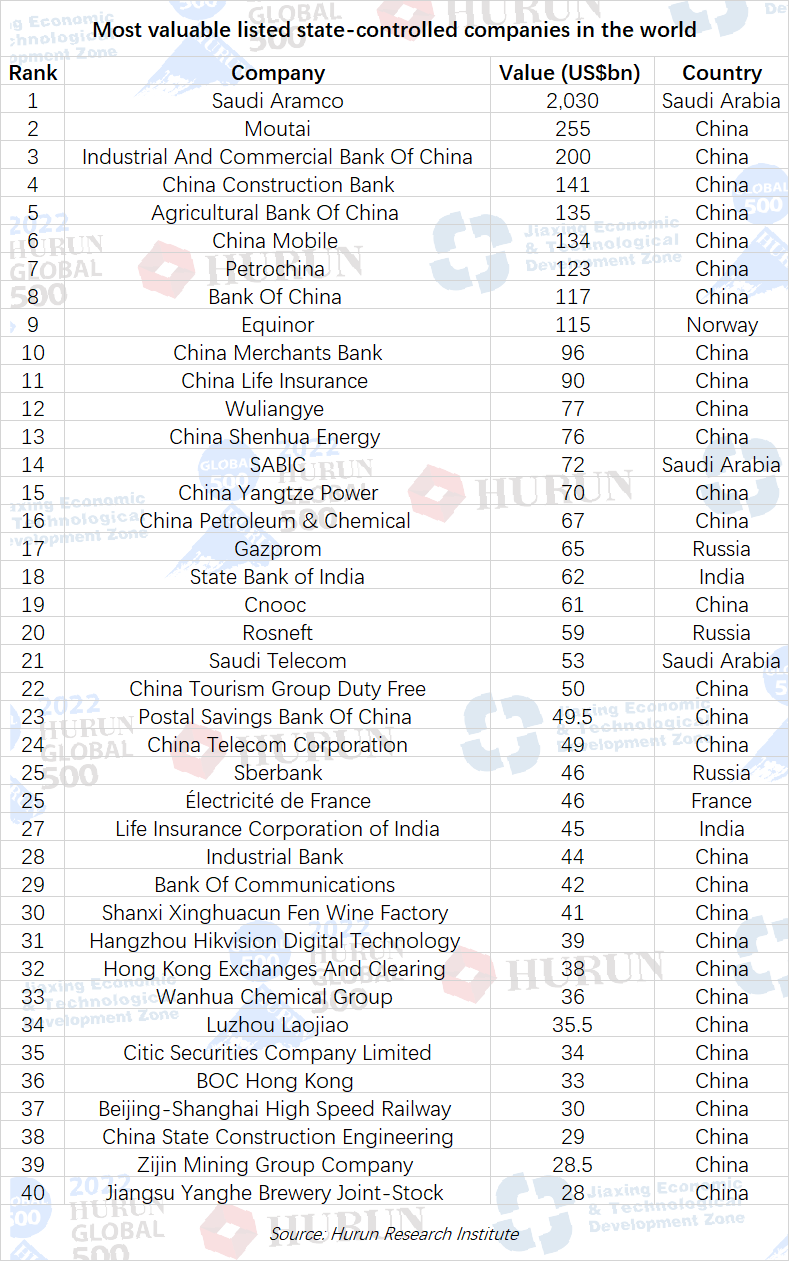

HURUN GLOBAL 500 ONLY INCLUDES NON-STATE COMPANIES, SO THE LIKES OF SAUDI ARAMCO (US$2.0TN) OR CHINA’S KWEICHOW MOUTAI (US$255BN) WERE OUT OF CONTENTION TO MAKE THE LIST.

320 COMPANIES, UP 2, FROM HURUN GLOBAL 500 DO NOT FEATURE IN THE FORTUNE GLOBAL 500

Hurun Research Institute today released the 2022 Hurun Global 500, proudly presented in association with Jiaxing City, Zhejiang Province, China

(9 December 2022, Wuzhen, Jiaxing, China and Mumbai, India) The Hurun Research Institute today, in association with Jiaxing City in East China, released the 2022 Hurun Global 500, a list of the 500 most valuable non-state-controlled companies in the world. Companies were ranked according to their value, defined as market capitalisation for listed companies and valuations for non-listed companies. The cut-off date used was 26 October 2022.

The cut-off to the Hurun Global 500 was down 23% from US$36.6bn to US$28bn. Total value was down 19% or US$11tn to US$47tn. 160 companies saw their values rise, of which 68 were new to the list. 340 saw their values drop or stay the same, and there were 68 drop-offs. 55% sell direct to consumers, whilst 45% are B2B. 54% sell physical products, with 46% sell software and services. By value, five industries make up half the Hurun Global 500, led by Financial Services, and followed by Healthcare, Consumer Goods, Energy and Software & Services. On average, these 500 companies have US$93bn of value, derived from sales of US$43bn, 86,800 employees and are 65 years old.

Global markets have had a bad year, with the exception of India, where the benchmark Sensex was up 12%. HK’s Hang Seng and Russia's MOEX were both down by a half, Korea's KOSPI down 31%, Shenzhen Component Index down 29%, Nasdaq was down 21%, Shanghai Composite Index down 16%, South Germany's DAX down 15% and the UK’s FTSE was flat.

The US dollar appreciated against all major currencies in the world with the Japanese Yen depreciating 25% against the US dollar, the South Korean Won down 19%, the Pound Sterling down 15% and both the Chinese Yuan and Indian Rupee down 10%. Depreciating only 7% with respect to the Dollar, the Swiss Franc, and the Canadian Dollar were the least affected among the world’s leading currencies. In this same period, oil rose by 23%.”

Rupert Hoogewerf, chairman and chief researcher of Hurun Report, said:

“The Hurun Global 500 are the backbone of the world’s economy. Together these 500 companies had combined sales of US$21.6tn, bigger than the GDP of China and India, and employed 43 million staff, equivalent to the working population of Germany. If you want to understand what is really going on in the world economy, understanding the stories behind the Hurun Global 500, the world’s most valuable companies, is a good place to start.”

“Hurun Report is delighted to partner with Jiaxing City from East China to release the Jiaxing EDZ · 2022 Hurun Global 500. Following the release of the list, Hurun Report in association with the government of Jiaxing City will be hosting the Jiaxing EDZ · Hurun Global 500 CEO Conference, bringing together executives from the G500 to discuss opportunities for 2023.”

“This year the Hurun Global 500 lost US$11tn of value, losing all the value created last year but still US$7bn ahead of where the Hurun Global 500 were two years ago. The only sector that enjoyed strong growth was energy, especially the oil & gas companies. Other sectors that managed to grow a little or stay flat included confectionary, drinks and fast-food restaurants. The hardest hit sector was retail, especially ecommerce, on the back of soaring inflation, which in turn dragged down payments and delivery companies. By country, 80% of the losses in value came from four countries: the US lost US$5tn, China US$2.9tn and Germany and Japan US$600bn each. By sector, US$8tn of losses came from Media & Entertainment, Retail, Financial Services, Software & Services and Consumer Goods.”

“The ‘World’s Big Four’ of Apple, Microsoft, Amazon and Alphabet stood out as the only companies for the second year running with trillion-dollar valuations. Of the ‘Big Four’, Apple withstood the global economic headwinds best, dropping only 3%, whilst Amazon was down a third as households felt inflation biting and Alphabet was down a quarter as advertisers cut their budgets.”

“The USA dominates when it comes to Hurun Global 500 companies, home to 52% of the G500 with 260 companies, and 65% or US$30.3tn of the total value, significantly ahead of second-placed China with 35 companies, representing 6% of the total value.”

“This concentration of economic power has gained the attention of the Chinese government, which has reacted with reforms hitting e-commerce platforms and real estate stocks hardest.”

“To create one of the Hurun Global 500 is a crowning achievement for anyone, but there are four individuals who have done it more than once, two of whom with four G500 companies each. Elon Musk is co-founder of three, Tesla, SpaceX and PayPal, and has just acquired a fourth, Twitter. The other is India-born Gautam Adani, with four new entries this year. Perhaps it is not surprising they are the two richest people on the planet. The other two are both from China: Jack Ma, who despite his recent troubles, co-founded both Alibaba and Ant Group, and Richard Liu Qiangdong, who co-founded ecommerce platform JD Group and fintech Jingdong Digits Technology.”

“One of the most outlandish stories of the last year belongs to a company that is not on this year’s Hurun G500, nor was it on last year’s list. In August this year, HK-based AMTD Digital shot up from its IPO price of US$1.5bn to hit a market cap of US$500bn, making it for a short time one of the Top 10 most valuable companies on the planet, before heading back down off the list to a current value of US$4bn. This was a RobinHood moment on a completely different scale to anything the world has seen before.”

“Value is perhaps the best way to measure a company’s performance, since value takes into account not just the current performance of a company but also its future potential. If a business is ‘valued at’ US$30bn, for example, it means that investors believe it is going to deliver profits of US$30bn within ten years. This changes as new information comes to light, such as impact of wars, inflation, government data, regulations and general sentiment.”

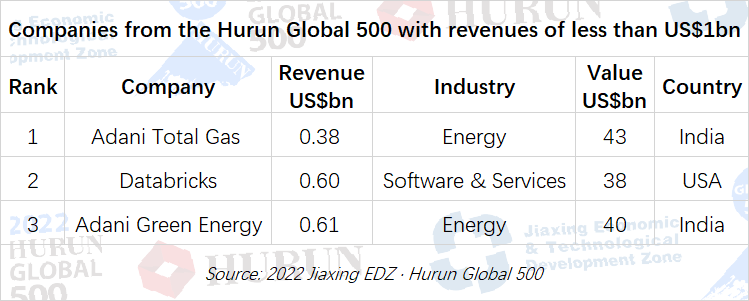

“Curiously, many of the Hurun Global 500 most valuable companies in the world had surprisingly low sales. Three of the Hurun Global 500 had sales last year of less than US$1bn, for example. India-based Adani Total Gas, for example, had revenues last year of ‘only’ US$380mn and only 400 employees, yet has a market cap of US$43bn, whilst US unicorn Databricks has a value of US$38bn, despite ‘only’ generating US$600mn of sales last year.”

“320 or 64% of the companies on the Hurun Global 500, which is ranked by value, are not on the Fortune Global 500, which is ranked by sales, such that the likes of Visa, worth US$529bn, as well as Eli Lilly and TSMC did not make the Fortune list. Hurun also does not include state-controlled companies, whilst Fortune does. Curiously, only 40 listed state-controlled companies, led by Saudi Arabia’s Aramco worth US$2tn, would have made the Hurun cut-off, up from 39 last year, of which the lion’s share of 30 were from China, led by the likes of baijiu brand Kweichow Moutai and ICBC. Ranking by value and not including state-controlled companies makes a huge difference. On the recent Fortune Global 500, China had – for the first time – more companies than the US, with 145 companies, up 2, whilst on the Hurun Global 500, there are only 35 Chinese companies, down 12, of which 24 did not feature on Fortune, including the likes of ByteDance and CATL.”

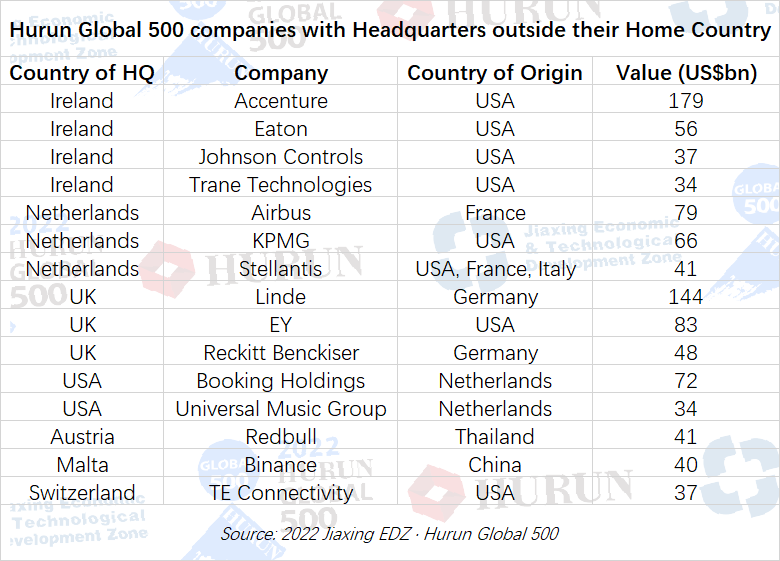

“15 companies from the Hurun Global 500 are headquartered in countries different to where they started. By country of destination, Ireland led the way with 4 companies, all originally from the US, followed by the Netherlands and the UK with 3 each.”

“As the US and European economies move on from the Covid years, this has had a big impact on the likes of video-conferencing platform Zoom, which dropped out of the list despite being worth US$107bn last year. Others impacted include Covid vaccine makers US-based Moderna (US$50bn) and BioNTech (US$32bn), which both halved in value, as the demand for vaccines decreased.”

“Media & Entertainment companies have had a difficult year as business cut advertising budgets in the face of economic uncertainty. Meta lost over US$600bn of value, after a year in which it revealed it had lost daily users for the first time ever and had its first quarterly decline in revenue. One of the biggest casualties was Snap, which last year was worth just shy of US$100bn and this this year dropped off the Hurun G500 completely, on the back of a rise in the impact of TikTok and Apple’s flexing of its economic muscle, with the introduction of its privacy feature.”

“Financial Services, the sector with the most companies on the Hurun Global 500, saw their value down 14% mostly on a slowdown in consumer spending. Insurance companies had a relatively stable year, whilst credit cards like Visa, MasterCard and American Express lost a quarter of their value, and payment companies like PayPal lost over two thirds of their value.”

“Energy companies enjoyed the best growth of the year, adding over US$1tn of value, led by Exxon Mobil, Chevron Corporation and Conoco Philips, which doubled in value.”

“Car companies have had a difficult year, down 21% in value on average. Tesla was worth US$700bn, more than the next 8 car makers combined. Toyota was second and Mercedes-Benz, Shenzhen-based BYD and Korea-based Hyundai overtook troubled Volkswagen in a year when Volkswagen spun off Porsche.”

“Consumer Electronics had a rough year, shedding an average of 31% of value with Dell Technologies dropping out of the list completely. Apple was the only one to maintain its value, down only 3%, whilst Beijing-based Xiaomi was down two thirds and Japan’s Nintendo down a third. The competition for chips was one factor.”

“Real Estate companies in the Hurun Global 500 lost 35% of value, mostly due to soaring mortgage rates and economic uncertainty. Headwinds caused by the high rate of inflation and geo-political tensions are putting expansions on hold.”

“After last year’s boom, created in part by the global chip shortage, semiconductors are down 29% as the global economy weakens, with expected impact on sales of new cars, personal computers and mobiles. Taiwan-based TMSC and California-based Nvidea between them lost more than US$400bn of value, leaving them with slightly over US$300bn of value each. Intel was down 50%.”

“Hurun has been promoting entrepreneurship through its lists and research since 1999. Hurun started out by telling the story of the Chinese economy through the China Rich List, the stories of China’s most successful entrepreneurs, and then expanding these stories to India and the rest of the world. Since then Hurun has gone on to tell the story of the world’s startup ecosystems, by ranking unicorns, before moving on to telling the story of the world economy by the 500 most valuable companies.”

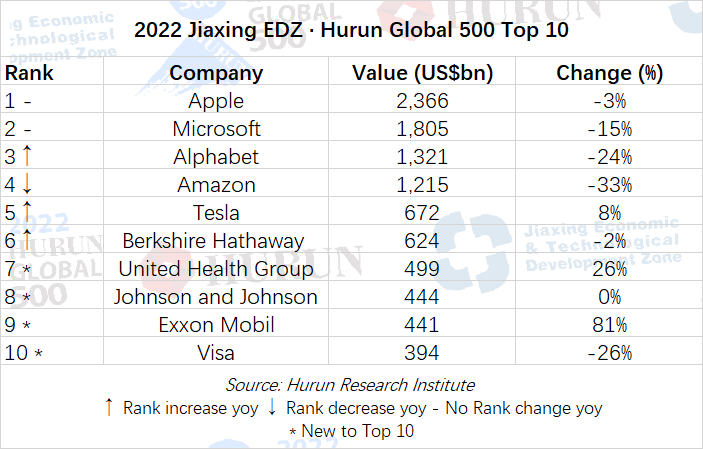

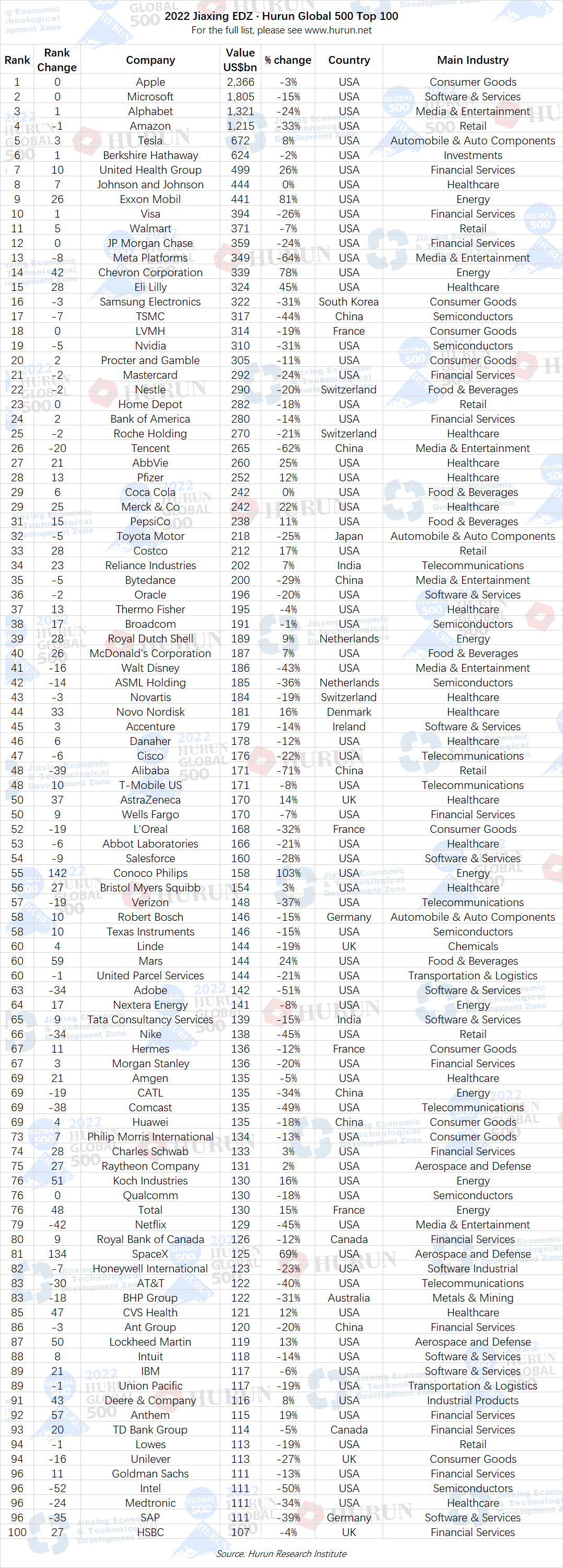

Top 10

The world’s Top 10 most valuable companies lost US$2.4tn in value, but still made up 21% of the total value of the Hurun Global 500. Alphabet overtook Amazon to third place. United Health Group, Johnson & Johnson, Exxon Mobil and Visa broke into the Top 10 at the expense of Meta (down 64% to 13th place) and three companies from Greater China: TSMC (down 44% to 17th), Tencent (down 62% to 26th) and Alibaba (down 71% to 48th). All of the top 10 are now from the USA.

Apple, Microsoft, Berkshire Hathaway and Exxon Mobil are the only companies from this year’s Top 10 that made the Top 10 ten years ago.

Table 1: 2022 Jiaxing EDZ · Hurun Global 500 Top 10

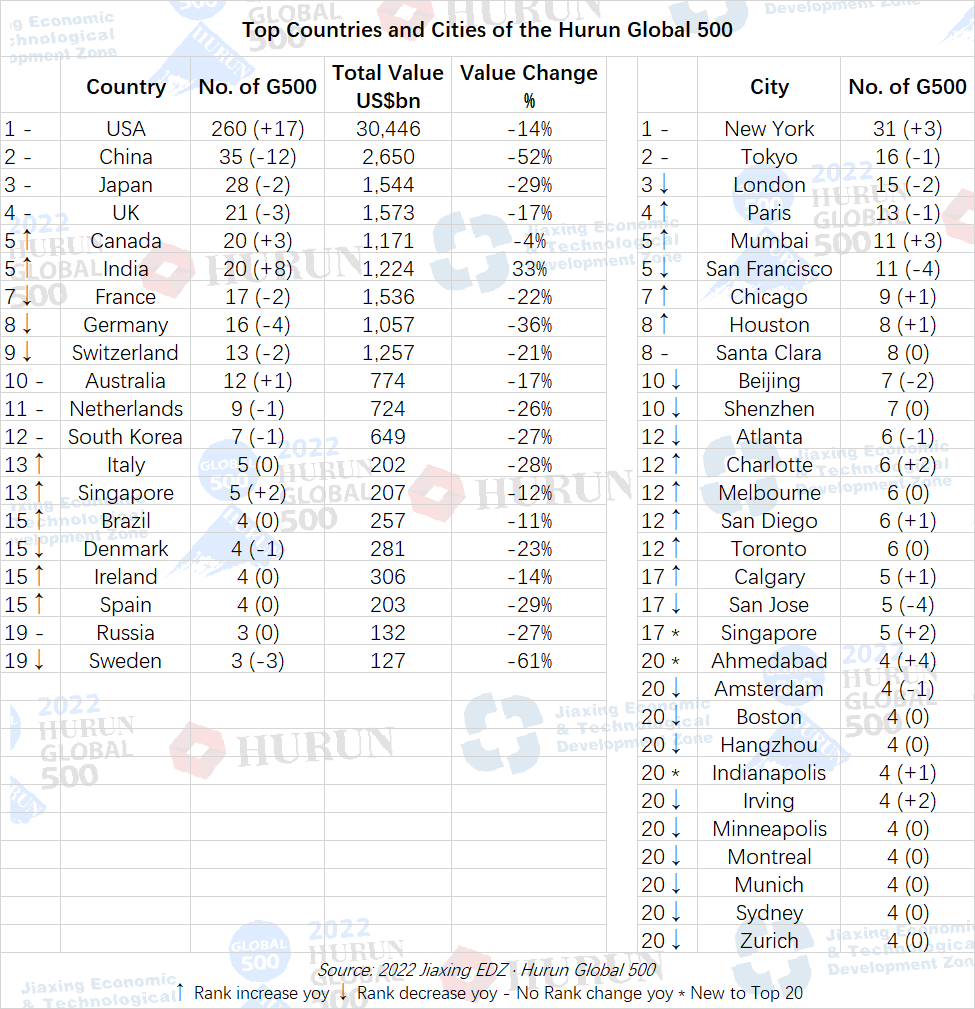

Where are they based?

The Hurun Global 500 came from 29 countries, up 1, with the US extending its domination, and followed by China, Japan and UK. India was the biggest riser after the US, adding 8, followed by Canada, which added 3 and Singapore, which added 2.

Of the US$11.1tn of value lost in the year, 80% came from four countries: the US lost US$5tn, China US$2.9tn, Germany and Japan US$600bn each. 90% of losses came from seven countries, including France, which lost US$400bn, whilst Switzerland and the UK lost US$300bn each.

The USA is home to 52% of the G500 with 260 companies, and 65% or US$30.3tn of the total value.

City-wise, New York is base to 31 companies in the Hurun 500, followed by Tokyo with 16, down 1. London dropped down to third place with 15. Mumbai moved up three places to 5th, whilst Ahmedabad in India was the fastest-growing city in the world for G500 companies, with four of Gautam Adani’s companies made the cut. Shenzhen with 7 G500 companies equalled Beijing for the first time, as the city with the most Chinese G500 companies.

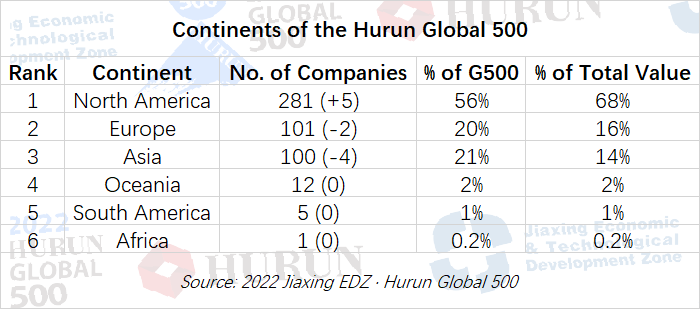

By continent, Europe (101) overtook Asia (100) for second place.

Table 2: Top Countries and Cities of the Hurun Global 500

Table 3: Continents of the Hurun Global 500

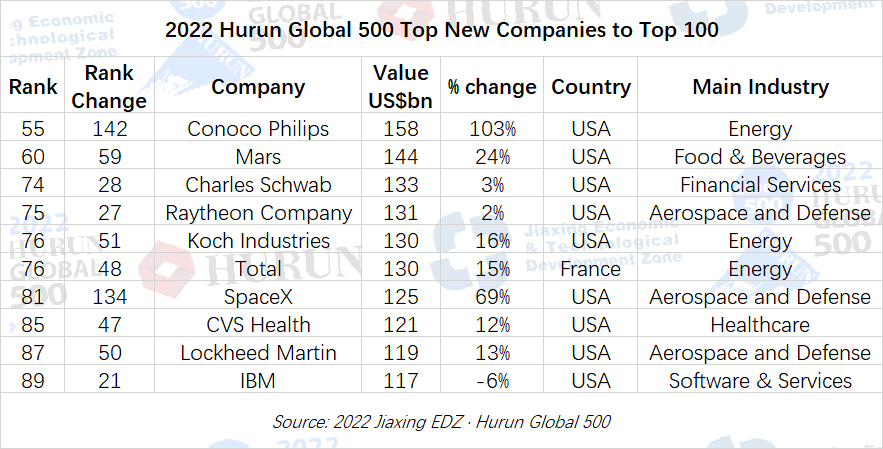

New to Top 100

15 companies broke into the Hurun Top 100 this year, led by energy giant Conoco Philips up 142 places to 55th place, after seeing its value double to US$158bn. Elon Musk-owned SpaceX moved up 134 places to 81st. Weapons makers Raytheon Company and Lockheed Martin saw their values up after the Russia-Ukraine war started.

Table 4: 2022 Hurun Global 500 Top New Companies to Top 100

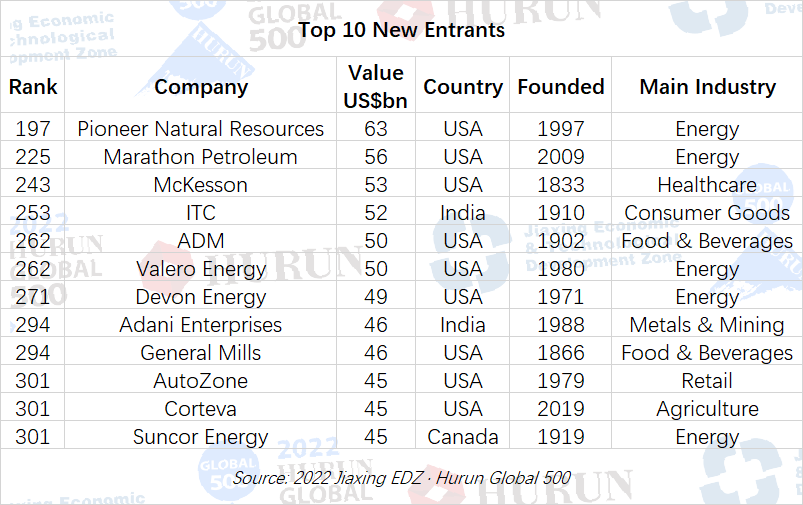

Where are the new faces coming from?

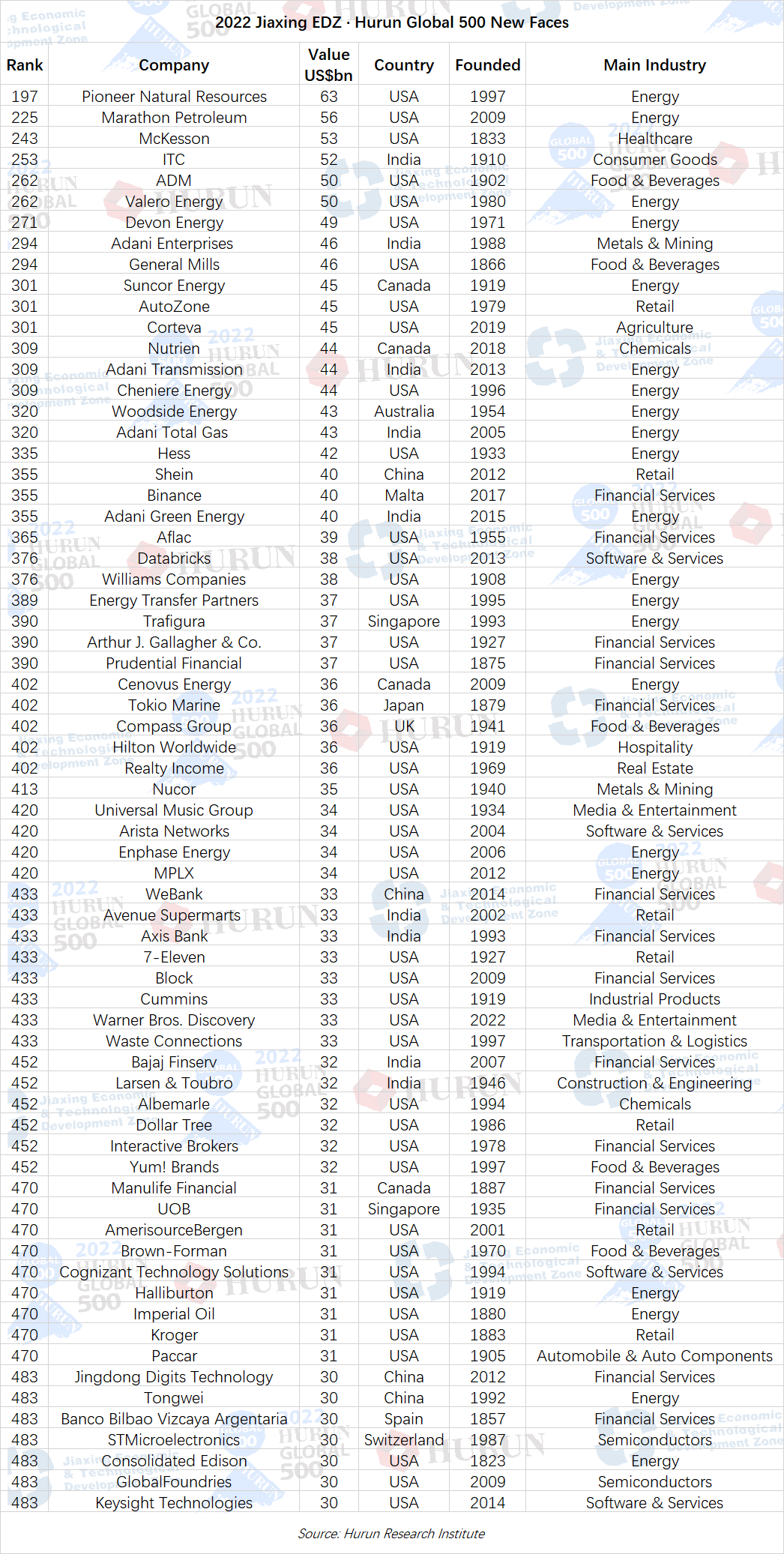

68 new companies broke into the Hurun Global 500 this year, led by USA energy company Pioneer Natural Resources, shooting straight into the Top 200 with a value of US$63bn. 24 of these companies were founded in the 2000s.

Energy led with 21 of the new entrants, followed by Financial Services with 14, Retail with 7 and F&B with 5. By country, 43 were from the US, followed by 9 from India, 4 from China and Canada each.

Four companies controlled by Indian billionaire Gautam Adani, made the Hurun Global 500 for the first time: Adani Enterprises worth US$63bn, Adani Transmission US$44bn Adani Total Gas US$43bn and Adani Green Energy US$40bn.

China-based fast fashion brand Shein at US$40bn, led 4 Chinese companies to break into the G500. The others being digital bank WeBank and fintech platform Jingdong Digits Technology and solar businesses Tongwei.

Others include US-based Databricks and crypto exchange Binance (US$40bn), Hilton Worldwide and restaurant operator Yum! Brands made a comeback. For the full list of new faces, see Appendix.

Table 5: Top 10 New Entrants

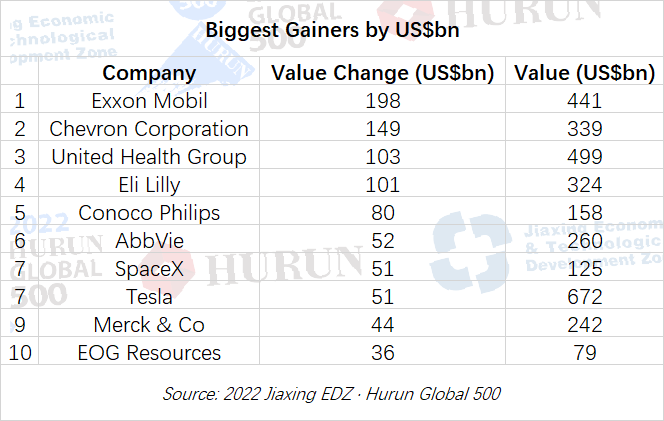

Biggest Gainers

By absolute value, the biggest gainers this year were Exxon Mobil up US$198bn, followed by Chevron Corp up US$149bn and United Health Group up US$103bn.

Paris-based Chanel and Seoul-based Hyundai Motor Company were amongst the fastest growing companies, rising 63% to US$92bn and 60% to US$78bn respectively.

Table 6: Biggest Gainers by US$bn

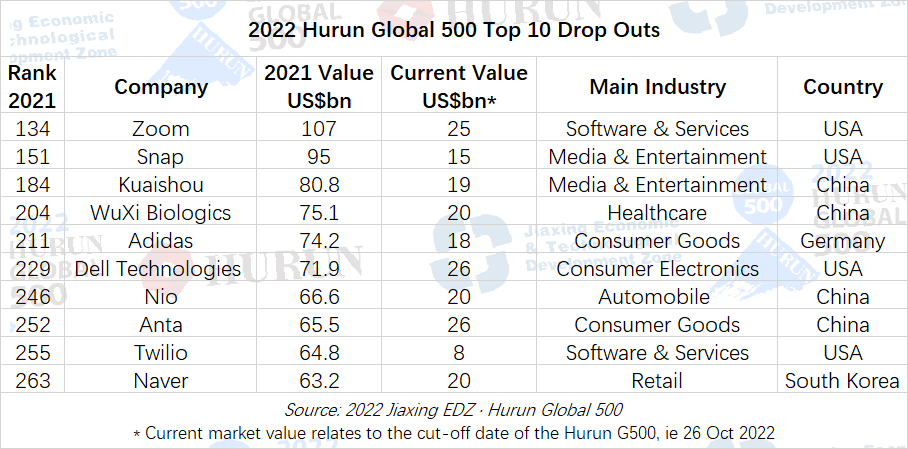

Drop Outs

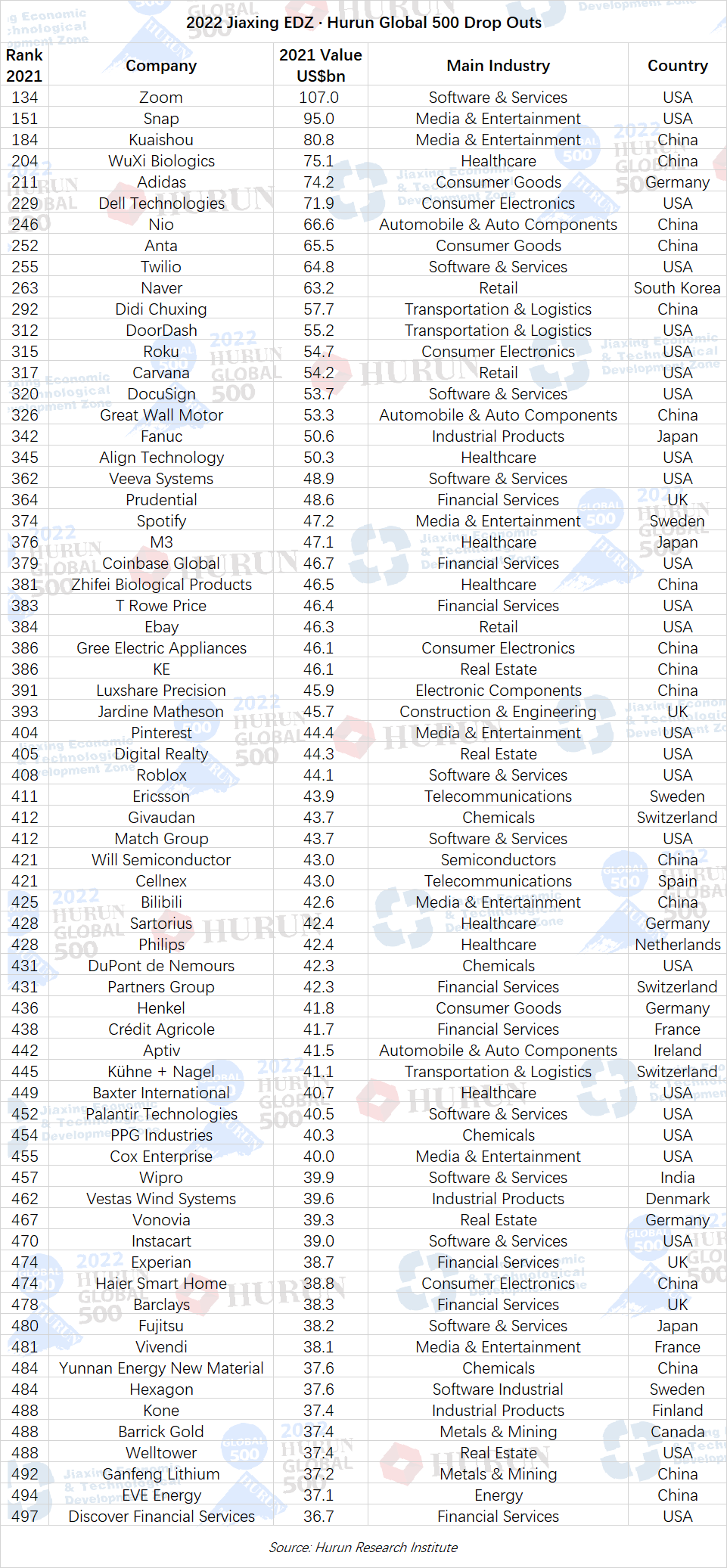

68 companies dropped out of the list, despite the cut-off dropping from US$36.6bn last year to US$28bn this year.

Video-conferencing platform Zoom, ranked 134 and worth US$107bn last year, was the biggest casualty, followed by California-based Snap and Beijing-based short-video platform Kuaishou. WuXi Biologics lost 73% in value after it was caught up in February in the US-China trade war. Adidas has struggled, on the back of weak sales, controversy over its relationship with Kanye West, and poor performance in China. The drop in Dell's stock price was based mainly on the spinoff of its 81% stake in cloud business VMware (Top 300, worth US$47bn).

Others that dropped off include crypto exchange Coinbase, after the crypto crash, and DoorDash, which has so far failed to convert its pandemic success to the bottom line, which has investors rightfully questioning whether it will ever generate a profit. For the full list of drop-outs, see Appendix.

By country, the US lost 25 companies, China 16, Germany and UK with 4 each and Japan, Sweden and Switzerland 3 each.

By sector, Software & Services saw 10 companies drop out, followed by Financial Services with 8 and Healthcare and Media & Entertainment with 7 each.

Table 7: 2022 Hurun Global 500 Top 10 Drop Outs

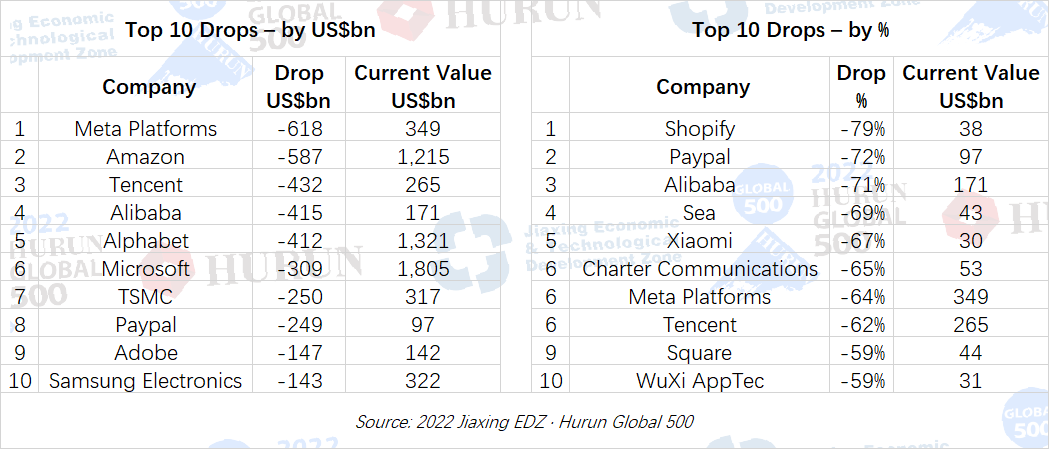

Biggest Losses in Value

Media & Entertainment, Retail, Software & Services and Financial Services had a difficult year and saw US$7tn losses in value.

Biggest losers in terms of absolute value were Meta Platforms, Amazon and Tencent.

In percentage terms Canadian e-commerce platform Shopify was the biggest loser, down 79%, followed by Paypal, down 72%, and Alibaba, down 71%.

Table 8: Top 10 Drops – by US$bn & Top 10 Drops – by %

Which industries performed and which did not?

Financial Services was the biggest contributor to the Hurun Global 500 with 104 companies or 21% of the list, followed by Energy with 57, which jumped to second place above Healthcare.

Energy and Food & Beverages were the only two sectors that grew by value. Energy led the way, growing by 39% and adding US$1.4tn of value, whilst F&B grew by 2%.

Of the US$11.1tn of total value lost this year, significantly all the losses came from just five industries: Media & Entertainment lost US$2.4tn, followed by Retail 1.6tn, Financial Services US$1.4tn and Software & Services and Consumer Goods each US$1.3tn. Between them, these five sectors have wiped out more than US$8tn over the last year.

Table 9: Industry Breakdown of Hurun Global 500

How old are they?

The average age of the top 500 companies is 65 years, i.e. founded in 1957. 122 companies – a quarter of the list – have a history of more than 100 years, of which five are more than 200 years old.

Many of the youngest companies are mergers of older companies, such as Warner Brothers’ merger with Discovery this year. Of the ten youngest companies, only Pinduoduo and WeBank of China, and Adani Green Energy India are start-ups.

Table 10: Youngest Companies & Oldest Companies

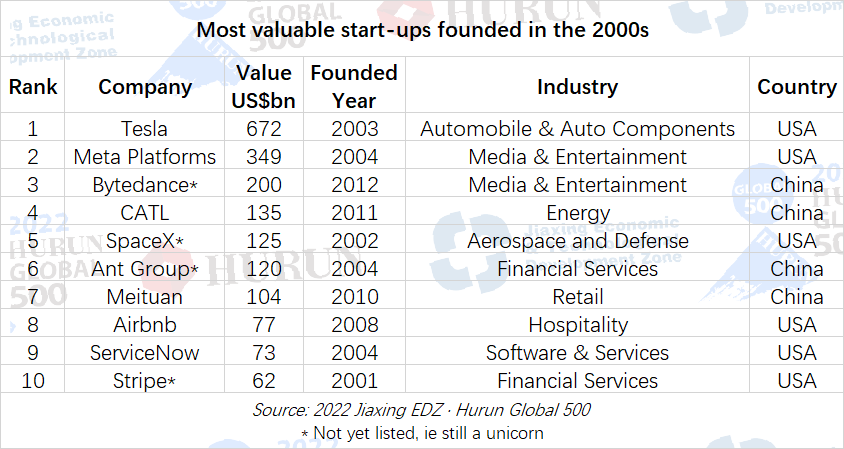

62 start-ups in the list were founded in the 2000s, making up US$6.7tn or 8.9% of the Hurun Global 500. 15 are founded in the last 10 years. Tesla is the most valuable start-up founded in the 2000s, followed by Meta Platforms.

Table 11: Most valuable start-ups founded in the 2000s

Less than US$1bn revenue companies

Whilst the average sales of the Hurun Global 500 were US$43bn, 119 of the Hurun Global 500 had sales of less than US$10bn, of which 3 managed to make the list with sales of less than US$1bn.

Founded in 2005, Adani Total Gas made the Hurun G500 with the least revenue, ‘only’ US$380mn, yet has a valuation of US$43bn. Databricks has a value of US$38bn with sales of ‘only’ US$600mn.

Table 12: Companies from the Hurun Global 500 with revenues of less than US$1bn

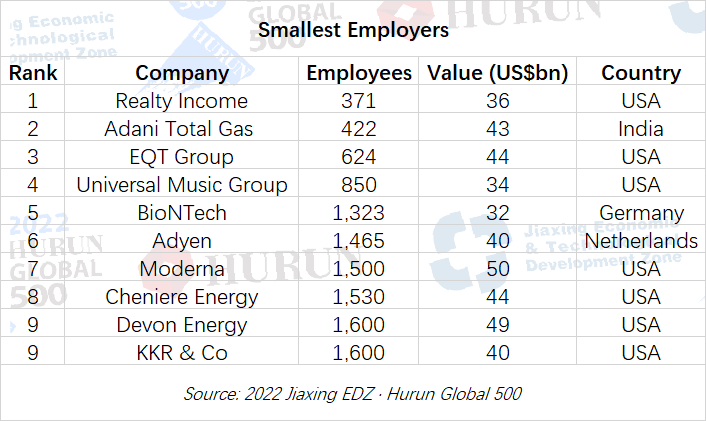

How many do they employ?

Companies from the Hurun Global 500 employ 43 million people around the world, an average of 86,700 per company. 94 have less than 10,000 employees, remarkable when the cut-off to make the list this year was US$26bn.125 have more than 100,000 employees, led by Walmart with 2.2 million employees and China-based Hon Hai Precision Industry (better known as Foxconn) with 826,000 employees.

Table 13: Smallest Employers

Country of origin versus headquarters

15 companies from the Hurun Global 500 are headquartered in countries different to where they started. By country of destination, Ireland led the way with 4 companies, all from the US, followed by the Netherlands and the UK with 3 each and US with 2.

Table 14: Hurun Global 500 companies with Headquarters outside their Home Country

Country by Country

USA: American companies occupied over half of the Hurun Global 500 places, with 260 companies, up 17 from last year. 101 saw their value increase, of which 43 were new faces. 134 saw their value drop and there were 27 dropouts. Together they had a combined value of US$30 trillion. New York had the highest number of companies (31), followed by San Francisco (11) and Chicago (9). With 46 companies, Financial Services is the main sector, followed by Healthcare and Energy with 32 and 30.

China. 35 companies from Greater China made the Hurun Global 500, with Taiwan-based TSMC overtaking Tencent for top spot. There were 4 new faces, led by Shein, WeBank, Jingdong Digits and Tongwei. 16 dropped out, led by Kuaishou, WuXi Biologics, Nio, Anta, Didi and including Gree and Bilibili. All last year’s companies saw their value go down. The China companies were spread across 19 cities, with Shenzhen and Beijing with 7 each and followed by Hangzhou 4. The average age was 27 years, much younger than the 65 average age of the whole list.

Japan retained 3rd spot on the Hurun Global 500 with 28 companies, 2 less than last year. With a valuation of US$218bn, 85-year-old Toyota Motors was the most valuable Japanese company followed by NTT (US$97bn) and Sony (US$81bn). Financial Services led the way with 4 companies followed by Automobile & Auto Components, Retail, and Healthcare with 3 each. The average age was 77 years, 12 years older than the average age of the whole list. Tokyo is the preferred city for 16 of the companies.

With 21 companies, UK retained 4th place on the Hurun Global 500, led by British-Swedish multinational pharmaceutical and biotechnology company AstraZeneca (US$170bn), and followed by Linde (US$144bn) and Unilever (US$113bn). The average age was 87 years, 22 years older than the average of the list. UK is home to the oldest company on the 2022 Hurun Global 500: the 324-year-old London Stock Exchange Group. Financial Services led the way with 7 companies, followed by Professional Services and Consumer Goods with 3 each. 3 of the Big 4 accounting companies are headquartered in London.

Canada is home to 20 companies from the Hurun Global 500 and rose to 5th place. 158-year-old Royal Bank of Canada, valued at US$126bn, is the most valuable Canadian company, ahead of 67-year-old TD Bank Group, valued at US$114bn. Financial Services led the way with 8 companies, followed by Energy with 5 companies. Retail with 3 companies. Toronto was the preferred city with 6 companies, followed by Montreal and Calgary with 4 each.

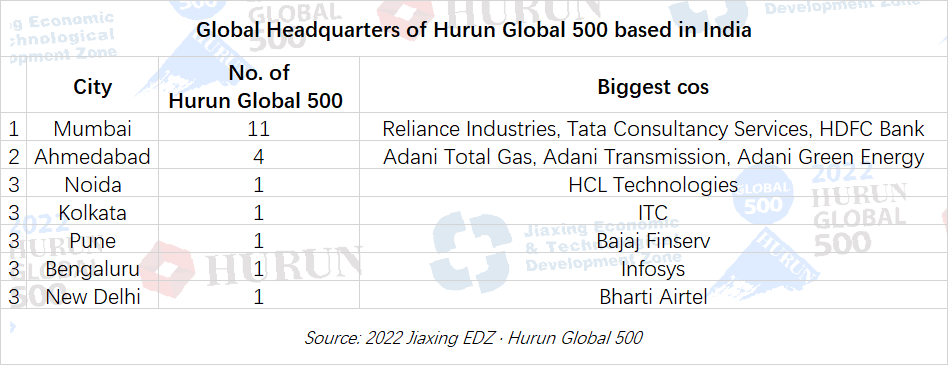

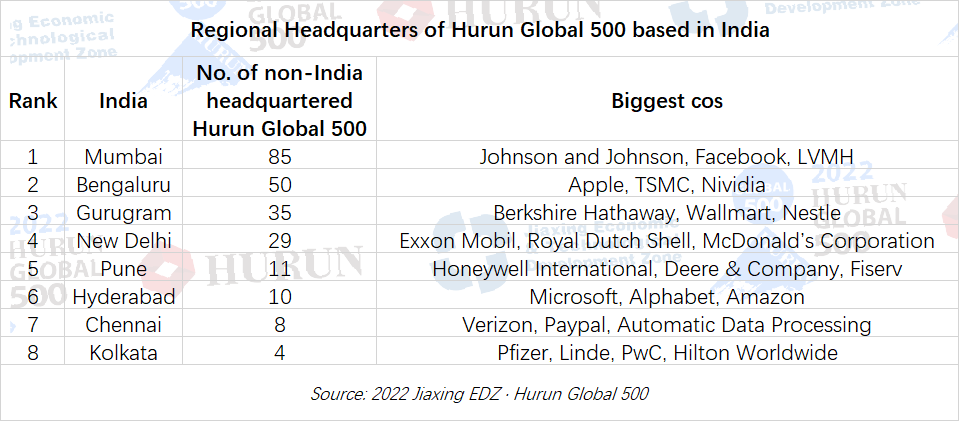

India rose from 9th rank to 5th rank with 20 companies: 11 in Mumbai, 4 in Ahmedabad and one in each of Noida, New Delhi, Bengaluru and Kolkata. With US$202bn, Reliance Industries is the most valuable company followed by Tata Consultancy Services (US$139bn) and HDFC Bank (US$97bn). Financial Services led the way with 7 companies followed by Software & Services and Energy with 3 companies each. 250 or 50% of the non-India Hurun Global 500 have a regional presence in India, spread across ten cities, led by Mumbai with 86, and followed by Bengaluru with 52, Gurugram 32, New Delhi 30 and Pune with 13.

France slips to 7th rank with 17 companies, down by 2. With US$314bn, LVMH was the most valuable company in France followed by L'Oreal (US$168bn) and Hermes (US$136bn). The combined value of French companies decreased by 22% to US$1.5tn. The average age was 96 years, 31 years older than the average age of the list. Consumer Goods led the way with 6 companies, followed by Financial Services, and Food & Beverages with 2 companies each. Paris was the preferred HQ.

With 16 companies, Germany went down to 8th place, led by Robert Bosch (US$146bn) followed by SAP (US$111bn), Mercedes-Benz and Siemens (US$92bn). Healthcare and Automobile & Auto Components led with 3 companies each. Financial Services and Transportation & Logistics have 2 companies each.

Switzerland was home to 13 companies, ranking it 9th in the list. The combined value of the companies was US$1.3tn, down 21%. Zurich was home to 4 companies followed by Basel and Baar with 2 companies each. Nestle and Roche Holding were the two most valuable Swiss companies, at US$290bn and US$270bn respectively, followed by Novartis (US$184bn). Healthcare and Financial Services led the way with 3 entrants each followed by Industrial Products with 2 companies.

Australia retained 10th spot with 12 companies, with 5 in Melbourne, 4 in Sydney and 3 in Perth. With US$122bn, BHP Group was the most valuable company in Australia, followed by Commonwealth Bank (US$106bn) and Rio Tinto (US$89bn). Financial Services led the way with 5 companies, followed by Metals & Mining with 3 companies. 187-year-old ANZ was the oldest Australian company in the list and at 19 years, Fortescue Metals Group the youngest. The combined value of the ‘kangaroos’ was US$774bn down 17%.

What about state-controlled companies?

The Hurun Global 500 focuses exclusively on non-state-controlled companies, meaning that state-controlled companies like Saudi Aramco (US$2.0tn) or China’s Kweichow Moutai (US$255bn) were out of contention to make the list.

Only 40 listed state-controlled companies would have made the cut, up from 39 last year, of which 30 were from China, 3 from each of Saudi Arabia 3 from Russia, 2 from India and 1 from each of France and Norway.

Table 15: Most valuable listed state-controlled companies in the world

Disclaimer. All the data collection and the research has been carried out by Hurun Research. This report is meant for information purposes only. Reasonable care and caution have been taken in preparing this report. The information contained in this report has been obtained from sources that are considered reliable. By accessing and/or using any part of the report, the user accepts this disclaimer and exclusion of liability which operates to the benefit of Hurun. Hurun does not guarantee the accuracy, adequacy or completeness of any information contained in the report and neither shall it be responsible for any errors or omissions in or for the results obtained from the use of such information. No third party whose information is referenced in this report under the credit to it assumes any liability towards the user with respect to its information. Hurun shall not be liable for any decisions made by the user based on this report (including those of investment or divestiture) and the user takes full responsibility for their decisions made based on this report. Hurun shall not be liable to any user of this report (and expressly disclaim liability) for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential losses, loss of profit, lost business and economic loss regardless of the cause or form of action and regardless of whether or not any such loss could have been foreseen.

2022 Jiaxing EDZ · Hurun Global 500 Top 100

Appendix: 2022 Jiaxing EDZ · Hurun Global 500 New Faces

Appendix: 2022 Jiaxing EDZ · Hurun Global 500 Drop Outs

Appendix: Global Headquarters of Hurun Global 500 based in India

238 or 48% of the non-India Hurun Global 500 have a regional presence in India, spread across ten cities, led by Mumbai with 85, and followed by Bengaluru with 50, Gurugram 35, New Delhi 29 and Pune with 11.

Appendix: Regional Headquarters of Hurun Global 500 based in India

About Jiaxing and Jiaxing Economic & Technological Development Zone

Situated in the northeast part of Zhejiang Province and bordering Shanghai, Suzhou, Hangzhou and Hangzhou Bay to the east, north, west and south respectively, the city of Jiaxing is at the geographical center of Yangtze-Delta city group. Thanks to its excellent location, good industrial base, rich innovation, social prosperity and stability, Jiaxing has become an active land for investment and inbound flow of population.

Located in the central part of Jiaxing city, Jiaxing Economic & Technological Development Zone (JXEDZ) is a typical urban development zone spanning 110 km2. Established in August 1992, JXEDZ was appointed one of the first provincial-level development zones by the Zhejiang Provincial Government. In March 2010, it became a national-level zone with the approval of the State Council. To this day, JXEDZ has served as the pioneer for Jiaxing city’s opening up, economic development and urban construction.

In recent years, JXEDZ seizes the opportunities that come with the national strategy of Yangtze River Delta Integration, keeps being open to foreign investment and continues to improve urban environment. By focusing on four major industries, namely auto parts, industrial equipment, healthy food and information technology, JXEDZ has fostered strong synergy between advanced manufacturing, modern services and intelligent sectors. With an international ideology based on win-win cooperation, legitimacy and integrity, and providing efficient, convenient and quality international services, JXEDZ attracts investors from all over the world. Up to now, there have been over 720 foreign-invested companies from over 40 countries and regions, including Europe, the United States, South Korea, Japan, Hong Kong and Taiwan. Among the global investors, 38 are “Fortune 500” enterprises, such as Mars, Abbott, ZF, LEGO, Panasonic, and Philips. For 8 consecutive years, JXEDZ has ranked 2nd in the appraisal of national-level zones in Zhejiang Province. It is also acclaimed as “National Development Zone of Investment Value”, “China's Top 10 Development Zones for Innovative Economic and Business Environment”, “Zhejiang Beautiful Demonstration Zone”, “Demonstration Zone for Low-carbon Development” and “Digital Economy Smart Zone”.

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai, Sydney, Paris

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion-leader in the world of business, Hurun generated 6 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich Index series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s two other key series include the Hurun Start-up series and the Hurun 500 series, a ranking of the world’s most valuable companies.

The Hurun Start-up series begins with the Hurun U30s, an awards recognizing the most successful entrepreneurs under the age of thirty, and is today in seven countries. Next up are Hurun Cheetahs, Chinese and Indian start-ups with a valuation of between US$300mn to US$500mn, most likely to go unicorn with five years. Hurun Global Gazelles recognize start-ups with a valuation of US$500mn to US$1bn, most likely to go unicorn within three years. The culmination of the start-up series is the Hurun Global Unicorn Index.

Other lists include the Hurun Philanthropy Index, ranking the biggest philanthropists, the Hurun Art Index, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial insitutions, real estate developers and regional governments.

Hurun hosted high-profile events in the last couple of years across China and India, as well as London, Paris, New York, LA, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Tel: +86-21-50105808*601

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Tel: +86-21-50105808

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net

Jiaxing Economic & Technological Development Zone Investment Promotion Bureau, please contact:

Tel: 021-60163333

Mobile: 15888398246

13605739636

Email: investment@jxedz.com